Understanding Safe Withdrawal Rate

Safe Withdrawal rate (SWR) is the key to answering “Am I (financially) ready to retire?”

What is Safe Withdrawal Rate?

The Safe Withdrawal Rate (SWR) is the percentage of your retirement portfolio you can withdraw annually, adjusted for inflation, without depleting your savings over a typical 30-year retirement.

The 4% Rule

Financial planner William Bengen established the widely-cited 4% rule (SWR of 4%) through historical market analysis, providing a benchmark for sustainable retirement withdrawals.

More recently Mr. Bengen has suggest 4.5% is a better number…

Reference: Wikipedia - William Bengen

More information: The Retirement Spending Solution

Why Not a Higher SWR?

People frequently think a SWR of 4%-4.5% sounds low, since the S&P 500 has real returns around 7%. With constant (no variability) returns, the SWR could be significantly more than 4%.

Sequence of Returns Risk

When an appropriate standard deviation is applied to reflect real-world market volatility, higher SWRs frequently fail.

See our content on Sequence of Returns Risk for more information: Understanding Sequence of Returns Risk

Real vs. Nominal Returns

Nominal Return

The percentage change in your investment’s value before accounting for inflation, taxes, or fees. This is the “headline” number you’ll see reported.

Real Return

Your actual purchasing power gain, calculated as nominal return minus inflation. This is what truly matters for your retirement lifestyle.

Example:

- S&P 500 starts at 1,000

- Ends year at 1,100; Nominal return = 10%

- Inflation was 4%; Real return = 6%

Important Note: Real Returns in This Analysis

Throughout this presentation, all financial figures and analyses, including withdrawal rates and portfolio values, are expressed in terms of real returns. This means all dollar amounts are adjusted for inflation and represent constant purchasing power, equivalent to today’s money.

This approach is crucial for retirement planning because it provides a clearer, more accurate picture of what your money can truly purchase in retirement. By accounting for inflation, we ensure our discussions reflect actual buying power, allowing for more realistic and actionable financial strategies.

Understanding Standard Deviation

Throughout this presentation, we will frequently refer to Standard Deviation (abbreviated stdev or STDEV) as a key measure of investment risk. It quantifies the amount of variation or dispersion of a set of values, giving us insight into how much an investment’s returns fluctuate from its average.

In simple terms, standard deviation tells you how spread out the numbers are in a data set. A low standard deviation indicates that data points are generally close to the mean, while a high standard deviation indicates that data points are spread out over a wider range of values.

For a normal distribution, understanding standard deviations helps predict the probability of outcomes:

- 68.2% of values fall within 1 STDEV

- 95.4% of values fall within 2 STDEV

- 99.7% of values fall within 3 STDEV

Mechanics of SWR Simulations

Generate data

- Select an average real rate of return and return STDEV.

- Generate 30 years of random data for that return and stdev.

Simulate account

- Apply the 30 years of data to an account balance with a given that has annual withdrawals at the given SWR.

Success/Failure

- Success is the account balance is > 0 at the end of the simulation; failure is a zero or negative balance.

Repeat the above 500 times for every SWR/return/STDEV combination, recording the ratio of Success/Failure.

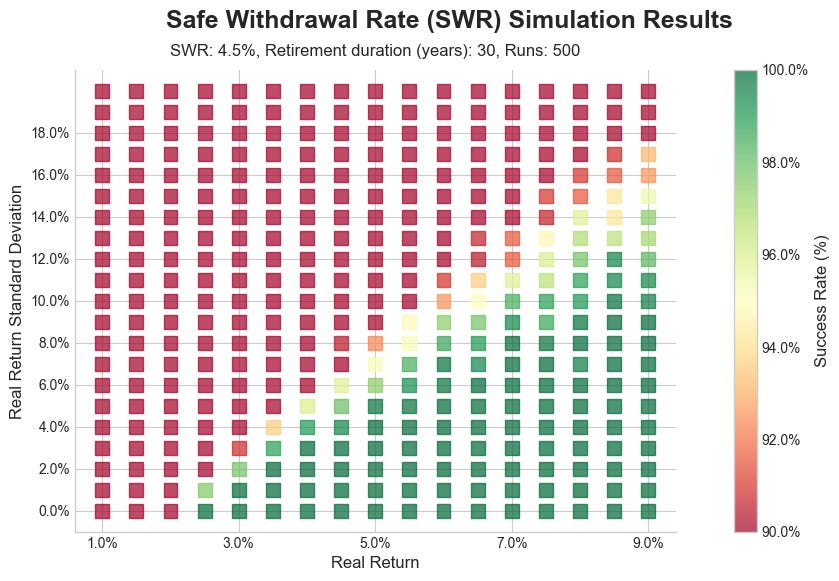

SWR Simulation - 4.5% SWR

Red points indicate the account ran out of money during a 30 year retirement at that return/STDEV.

I.E. at a real return of 5%, with a 5% stdev, the success rate is high; while the same return at 10% stdev (or more) has a low success rate.

Critical Insight: High returns don’t guarantee success.

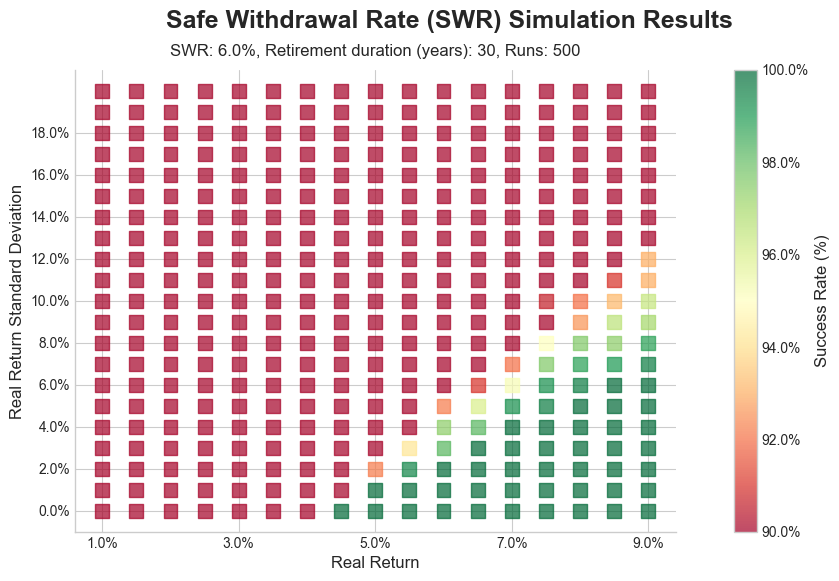

SWR Simulation - 6.0% SWR

At this higher SWR, there is little space for success.

Where can you get 5% real return at near 0 stdev? Or 7% real return at 4% stdev or lower?

Question: How do investment options map into this space?

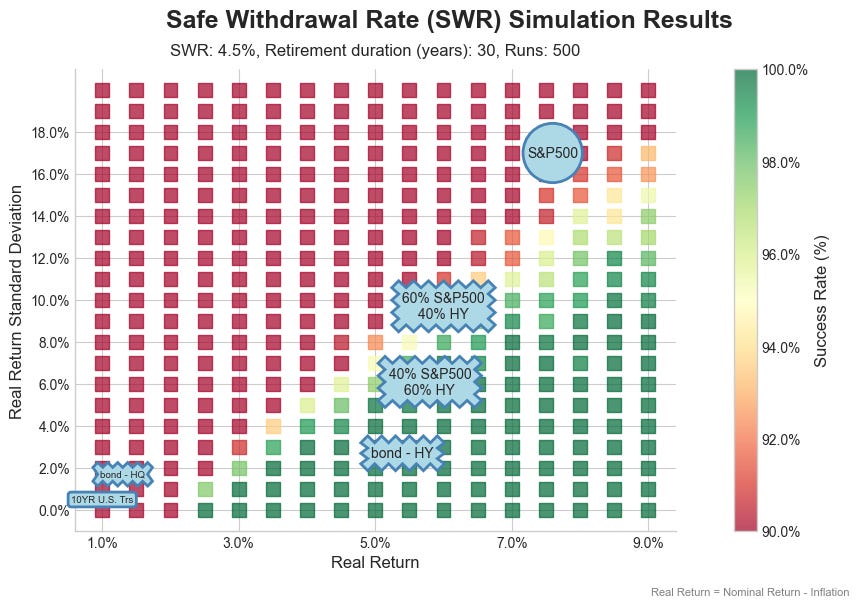

Historical Real Returns

High Quality Corporate bonds

- 2005-NOV 2025

- Real mean return: 1.3%

- stdev: 1.7

- Ref: https://fred.stlouisfed.org/graph/?graph_id=1529418&rn=451

High Yield Corporate bonds

- 2005-NOV 2025

- Real mean return: 5.4%

- stdev: 2.7

- Ref: https://fred.stlouisfed.org/graph/?graph_id=1533871&rn=671

S&P500

- 1991-NOV 2025

- Real mean return: 7.6%

- stdev: 17.2%

- Real CAGR: 6.1%

Compound Annual Growth Rate (CAGR) is generally lower than the arithmetic mean (or average) return, especially in volatile markets, because CAGR accounts for compounding while the arithmetic mean does not. See our content on “Average Annual Return, It is Not What You Think”

Investment Options Overlayed On SWR 4.5% Map

- Treasuring and/or investment grade bonds don’t have enough return to be successful

- 100% stocks has too much volatility to be successful

- A mix of investments is needed to reduce volatility in order to be successful

(Current yield spreads are lower than shown.)

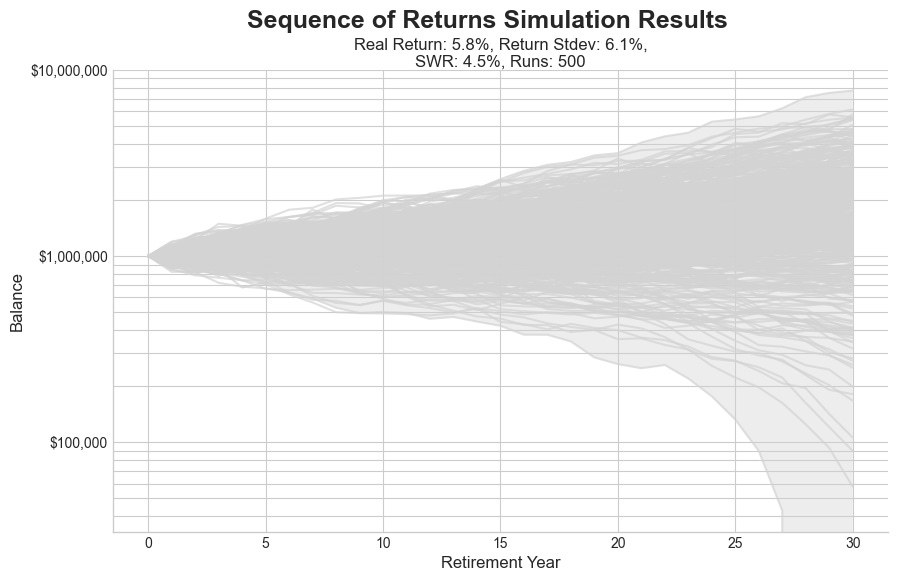

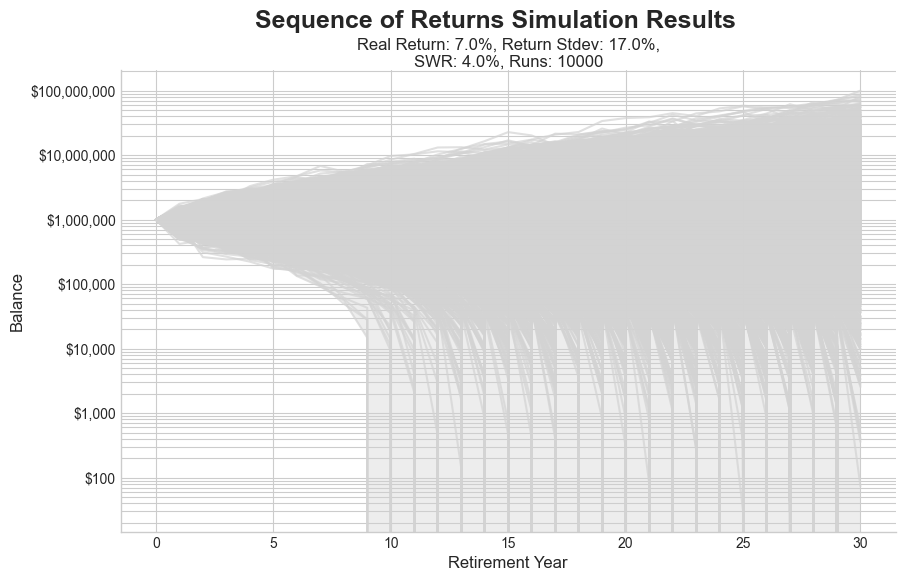

Simulated Sequences of Returns with Mixed Portfolio

This plots shows the results of 500 simulated 30 year retirements using the mixed portfolio return and stdev.

Note: a single failure, but many cases where the portfolio grows, up to ~ $10M

Simulated Sequences of Returns with 100% Stocks

This plots shows the results of 500 simulated 30 year retirements using returns of the 100% stock portfolio.

Note: MANY failures.

Key Takeaways:

Diversification Over High Returns

Diversification and managing return variability are more crucial than solely chasing the highest returns, as demonstrated by the diversified portfolio’s superior position. A thoughtful asset allocation strategy, balancing risk and reward, is paramount.

The Value of Anti-Correlated Assets

Anti-correlated assets (like stocks and bonds) move in opposite directions during different market conditions, which reduces overall portfolio variability. This reduced variability is what creates the superior success rates we see in diversified portfolios - it’s not just about mixing assets, but specifically combining assets that don’t move together.

How to Use (and Not Use) This Information

Success Depends on Managing Return Variability

A successful retirement plan is highly sensitive to both investment returns AND the variability of those returns.

Diversify with anti-correlated assets to try to reduce return variability.

Understanding Model Limitations

The models used assume investment returns follow a “normal distribution” (a specific statistical pattern). In reality, market returns don’t always behave this way, even with portfolio diversification.

Real economies are cyclical, leading to periods of expansion and contraction. This means your personal results may be biased by market timing, but predicting these biases is impossible.

Practical Application Guidance

DO NOT: Rely on this analysis to pick exact Safe Withdrawal Rates (SWRs), precise return targets, or specific standard deviations for your personal financial plan.

DO: Focus on understanding the underlying principles of investment variability and its impact.

Use these insights to inform a flexible and adaptive retirement strategy that can adjust to evolving market conditions and personal circumstances.

Ready to learn more?

Dive deeper into investing, saving, and withdrawal strategies through our comprehensive Learning Track.

Prefer updates in your inbox? Subscribe via Substack to get all our content delivered straight to you via email.

We love hearing from our readers. If you have questions about this post, or want to suggest a topic for a future article, please use the Chat link on our Substack home page to reach out.

Thanks for reading! This post is public so feel free to share it.

Disclaimer

**For Educational Purposes Only:** All content on this site, including articles, tools, and simulations, is for informational and educational purposes only. It should not be construed as financial, investment, legal, or tax advice. The information provided is general in nature and not tailored to any individual’s specific circumstances.

**Software Development Has Inherent Risks:** The software used to perform the analyses may have errors or inaccuracies. When we post updates to any material, errors or inaccuracies that are subsequently fixed may change the results.

**No Guarantees & Risk of Loss:** The analyses and simulations presented are based on historical data. Past performance is not an indicator or guarantee of future results. All investing involves risk, including the possible loss of principal. Market conditions are subject to change, and the future may not resemble the past.

**No Fiduciary Relationship:** Your use of this information does not create a fiduciary or professional advisory relationship. We are not acting as your financial advisor.

**Consult a Professional:** You should always conduct your own research and due diligence. Before making any financial decisions, it is essential to consult with a qualified and licensed financial professional who can assess your individual situation and objectives. We disclaim any liability for actions taken or not taken based on the content of this site.

* Nobody associated with Algorithmic Fire LLC has any credential(s) or affiliation(s) with any licensing or regulatory bodies, including but not limited to: Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA).

© 2025 Algorithmic Fire LLC. All rights reserved.